As U.S. companies increasingly expand their e-commerce endeavors into global markets, many are surprised to learn that international customers don’t use the same payment platforms Americans do.

Worse still, these companies often quickly learn that by not offering locally-preferred payment options, fewer customers visit their global sites-which means far less traffic, engagement, conversion and revenue than expected. A brand's online ambitions can quickly sink when company decision makers ignore local payment options.

In South Korea, for instance, global brands usually generate only 20% of what they’d otherwise earn, simply because they didn’t support local payment types.

"Online merchants' websites need to be fluent in more than just a market's preferred language," explains Blas Giffuni, director of MotionPoint's Global Growth team. "They must communicate, and cater to, the understanding of a culture's perspectives on debt and credit-and that local users are more comfortable with their own payment options."

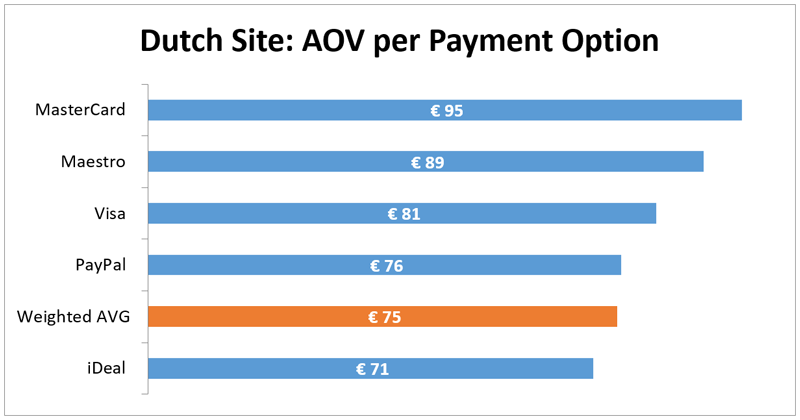

This financial fluency provides invaluable insights in new markets. For instance, we've found that payment options linked to a direct bank transaction (such as PayPal, or the Netherlands' iDeal, or Germany's Giropay) usually have a lower Average Order Value, but they're used more often than regular credit cards.

More orders beats higher AOVs every time. One of our clients, who leveraged iDeal in the Netherlands, saw 377% higher sales on that platform than on MasterCard and Visa combined.

Every country and market has unique payment preferences. But combining third-party research with our own 15 years of data and experience operating global e-commerce sites, MotionPoint can provide some general, yet valuable, insights on global payment trends.

We’ll also briefly highlight the preferences of several European markets.

Make no mistake: credit cards have deep penetration in many global markets, and will remain the preferred form of payment for some time. But in key developed markets and especially emerging markets—where most expanding companies wish to engage online—this isn’t the case. Consider these findings, seen in Adyen’s Global E-Commerce Payments Guide:

These markets, and others, prefer to use alternate payments such as e-wallets. According to Worldpay’s Global Payments Report, e-wallet platforms will overtake credit cards by 2019. In many respects, these platforms are more contemporary, and serve global customers more effectively thanks to convenience (users don’t have to repeatedly enter card details), increased security, and an increasing penetration in omnichannel retail (empowering shoppers to pay via e-wallet in apps, online and in-store).

Retailers that integrate regional e-wallet platforms into their e-commerce offerings often see immediate improvements in sales. When one of our clients offered e-wallet platform Alipay as a payment option on its Chinese site, conversions immediately grew by 217%. Item quantity per transaction grew by a third. Revenue grew by 210%. Returning visitors skyrocketed.

Watch for prepaid e-vouchers to grow in popularity, too. Funds from these digital vouchers (which can be generated from real-world terminals or websites) can be transferred to a user’s prepaid card, or an online account with a retailer.

Indeed, “the golden age of credit is over” in credit-driven economies, the Global Payments Report suggests. Global consumers are exerting greater control over their finances, as seen with the increase in debit and prepaid payment methods. “No longer do consumers want to burden themselves with debt,” the report says. “They are hyperaware of the damaging effect of credit, and their buying behavior has changed accordingly.”

Expect prepay payment options to represent at least 7% of global payment share by 2019.

As in years past, cash on delivery remains a popular payment option for consumers in emerging markets such as India, Indonesia and Russia. Until consumers’ trust in digital payment methods increase in these markets, retailers should consider COD a viable payment option, and offer it.

Privacy is also a particularly important concern in many markets, Blas explains. “European consumers, especially in Northern European markets, like to have more control on the personal information that gets shared, the transaction and the exchange of funds,” he says.

This behavior has sparked innovations in certain payment options-especially in e-wallet platforms such as iDeal, Giropay and Sweden's Klarna. These privacy-conscious measures provide retailers with less risk and less overhead of previous local payment options (such as pay-by-invoice), while providing consumers with simple and secure user interfaces.

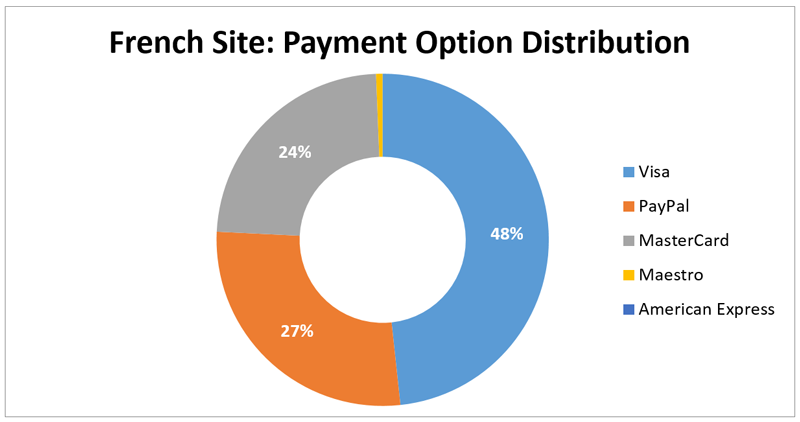

Shifting from general trends to specific markets, MotionPoint recently examined nearly 29,000 transactions conducted on the French e-commerce site for a fashion retailer. According to our analysis, France remains a market where credit cards are the preferred payment method. But that tells only part of the story.

Visa leads the market, thanks mostly to its famous decades-old Carte Bleue offering (which was phased out in 2010, and replaced with Visa Classic debit). However, PayPal usage surpassed other traditional card offerings such as MasterCard, Maestro and American Express.

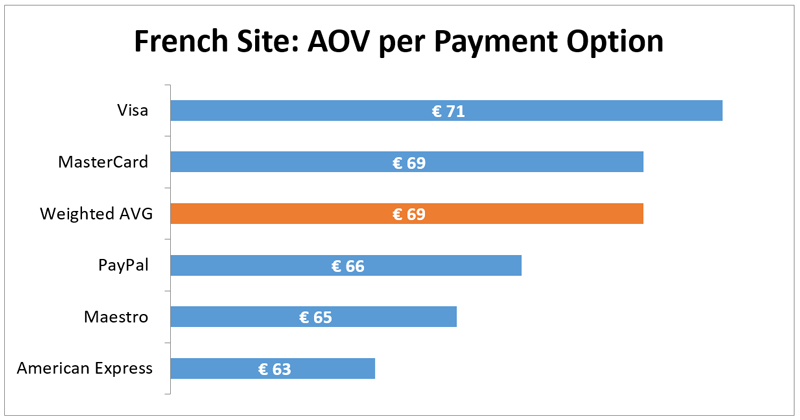

AOV for MasterCard transactions are €3 higher than PayPal transactions.

“However, the site generated more revenue via PayPal,” Blas says, “thanks to the increased number of shoppers using the e-wallet platform.”

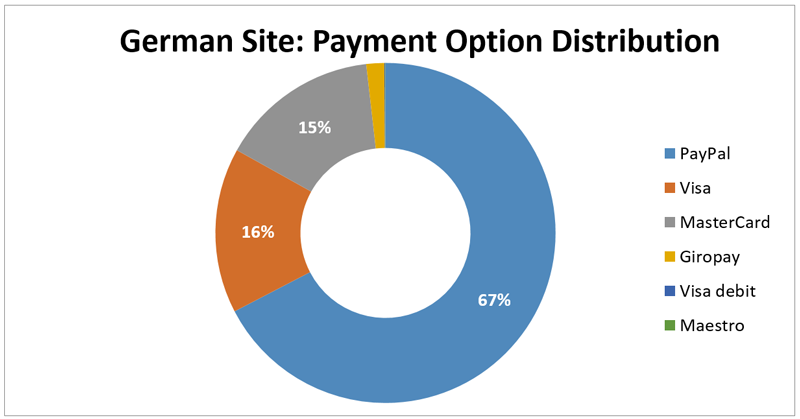

"Germans are very security conscious, and have less trust in e-commerce sites than other European shoppers," Blas explains. "As a result, Germans far prefer bank transfers and payment-on-delivery over credit cards for e-commerce payment."

This aligns with our own observed low credit-card use by Germans. Based on nearly 17,500 transactions we recently tracked on a fashion brand's German site, 70% were conducted via the PayPal platform.

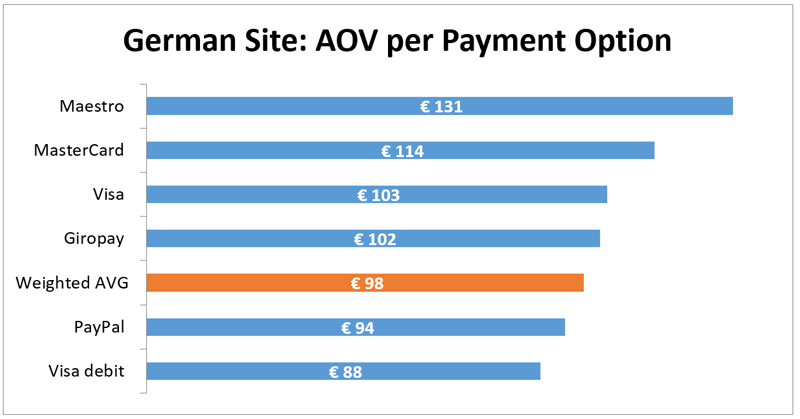

As seen in France, AOV for German PayPal-based transactions was lower than those made on credit cards. However, the quantity of PayPal transactions was considerably higher than these other payment options.

“But our analysis also indicates that bank-transfers—and payment options where consumers have more control over managing their funds, like Giropay and Klarna—are growing as preferred payment options among Germans,” Blas says.

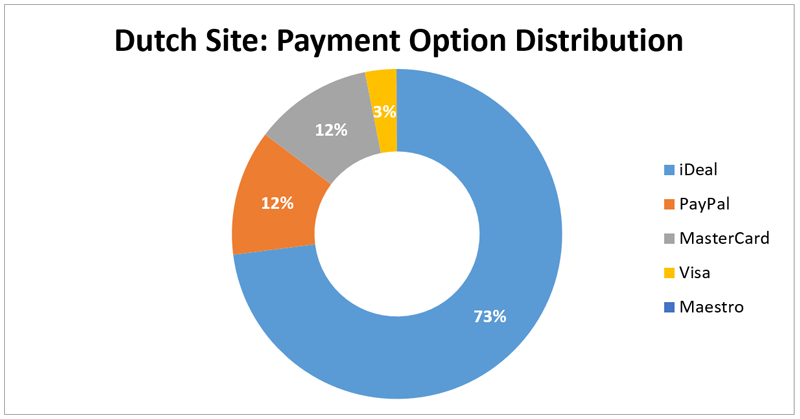

We also recently examined nearly 10,000 transactions conducted on a fashion retailer's Dutch e-commerce site. For this market, the takeaway was clear: e-wallet platforms reign supreme. An astonishing 85% of all online transactions were conducted via iDeal and PayPal!

iDeal led the preferred-payment pack with a 70% share of transactions. PayPal was the second-preferred option of our sample, barely eking ahead of MasterCard.

"Once again, this illustrates that in markets where credit card consumption is low, alternate payment options tend to overindex," Blas explains. "The appeal of these platforms is clear: consumers have more control over the distribution of their funds."

We’ve reported in other posts how U.S. retailers targeting U.S. Hispanics quickly see a lift in traffic and transactions from other Spanish-speaking markets. In fact, it’s normal to see 40% to 60% of all Spanish-site transactions hailing from Latin American shoppers.

"Even when shipping to their home country isn't supported, international users find very creative ways to get products they really want," Blas says. "One of the most common ways is to make the online purchase from their country, and have a U.S.-based friend or family member hold the package, or send it with friends. It's basically an informal version of 'freight forwarding.'"

MotionPoint has seen its clients adapt to these global consumers, and has observed increased sales and revenue as a result. This adaptation might require accepting a less popular payment option in the U.S. For instance: while Diners Club International cards may not be a part of the American zeitgeist like they were in the 1960s, they're still popular in Latin American countries such as Ecuador and Colombia.

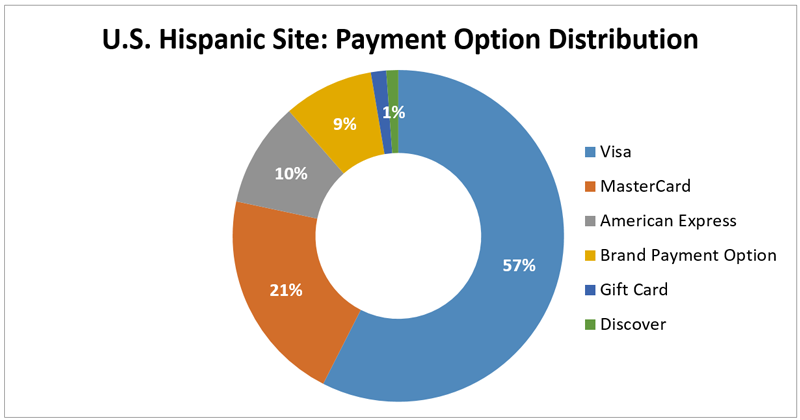

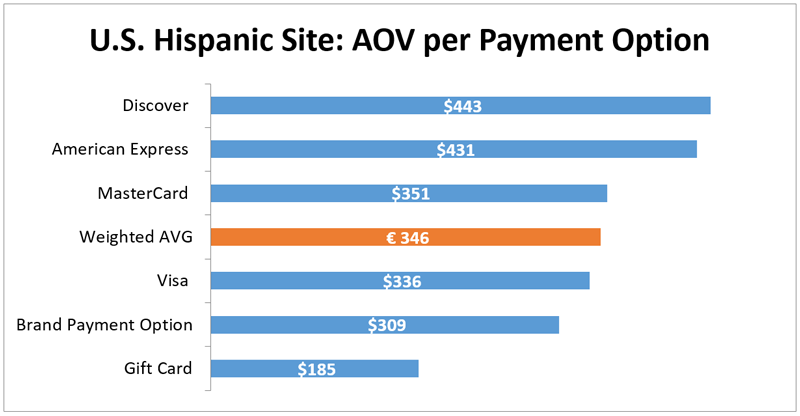

And U.S. Hispanics themselves are a thriving market to target, particularly with rewards programs, Blas says. This was seen in our recent analysis of 17,000 transactions on a Spanish-language e-commerce site for a U.S. consumer electronics retailer.

"U.S. Hispanics tend to be very faithful to brands that market to them," he points out. "This can be seen by a 9% increase in transactions being conducted via a branded credit card, or brand rewards program."